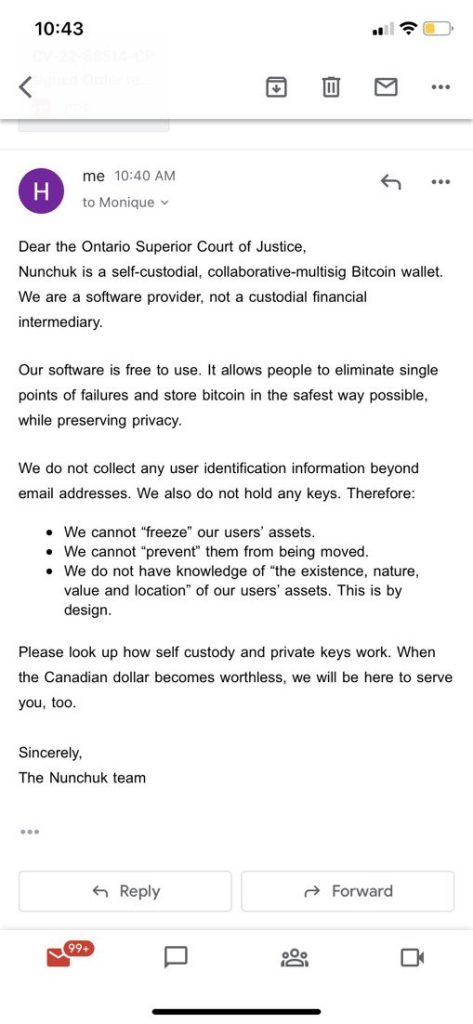

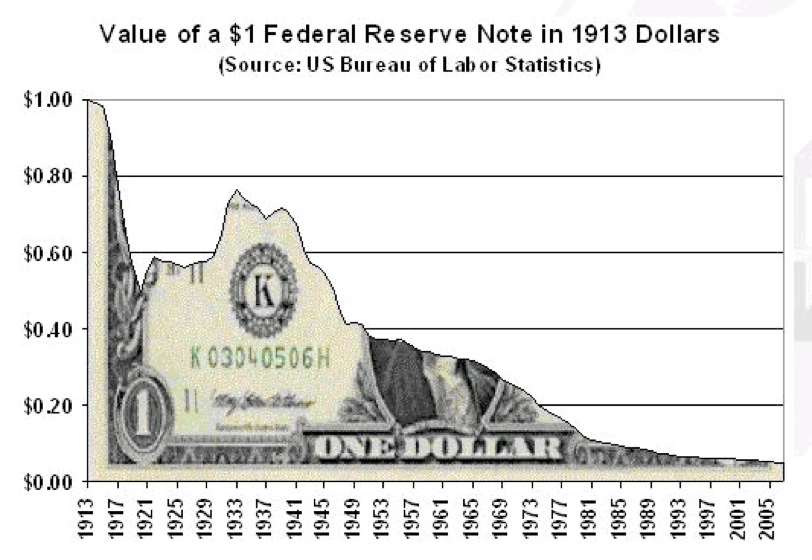

Trudeau is threatening to confiscate bank accounts. Steve Cortez and others has been warning of coming Stagflation. Steve has been a part of Wall Street as a trader and strategist for almost two decades. Others such as Clif High warn of a coming dollar collapse.

Ed Dowd, a former Blackrock Portfolio Manager, reports on Falling Pharma Stocks And Coming Financial Collapse. Edward has said elsewhere how COVID-19 may have been used to cover global debt, and how he predicts a financial collapse is ahead of us.

https://rumble.com/vvc53k-ed-dowd-reports-on-falling-pharma-stocks.html

And now even Tucker Carlson is warning of the problems if the US dollar loses it’s World Reserve Currency status.

On the other hand Edward Harrison, a senior editor at Bloomberg, wrote in 2011 an article On Hyperinflation explaining why the US dollar is still solid because it is the World Reserve Currency. The fly in the ointment is explained in this March, 2013 article, BRICS plan new 50bn bank to rival World Bank and IMF, and The China-Australia Currency Swap Agreement.

… the bilateral currency swap agreement on 22 March 2012. The agreement allows exchange of local currencies between the two central banks…’” thus cutting out the US Dollar as the exchange currency.

The China-Australia Currency Swap Agreement.

Given these circumstances, I thought a discussion about Central Banks and the US dollar was appropriate. I hoped the Q tree could benefit from having this information all in one place.

http://www.silverbearcafe.com/private/06.20/images/servitude.jpg

“Inflation is the surest way to fertilize the rich man’s field with the sweat of the poor man’s brow.”

Charles Holt Carroll (1799-1890.)

Daniel Webster expanded on that idea.

“Of all the contrivances for cheating the laboring classes of mankind, none have been more effectual than that which deludes them with paper money. This is the most effectual of inventions to fertilize the rich man’s field by the sweat of the poor man’s brow. Ordinary tyranny, oppression, excessive taxation — these bear lightly on the happiness of the mass of the community compared with fraudulent currencies and the robberies committed by depreciated paper. Our own history has recorded for our instruction enough, and more than enough, of the demoralizing tendency, the injustice, and the intolerable oppression, on the virtuous and well disposed, of a degraded paper currency, authorized by law, or in any way countenanced by government.”

Daniel Webster (1782 -1852) Statement to the Senate in 1832

With encouragement from Senators Clay and Daniel Webster, Mr Nicholas Biddle, then President of the Second Bank of the United States, applied for a renewal of the Bank’s charter in 1832. President Jackson vetoed the renewal, stating “. . . It appears that more than a fourth part of the stock is held by foreigners and the residue is held by a few hundred of our citizens, chiefly of the richest class. . .” LINK

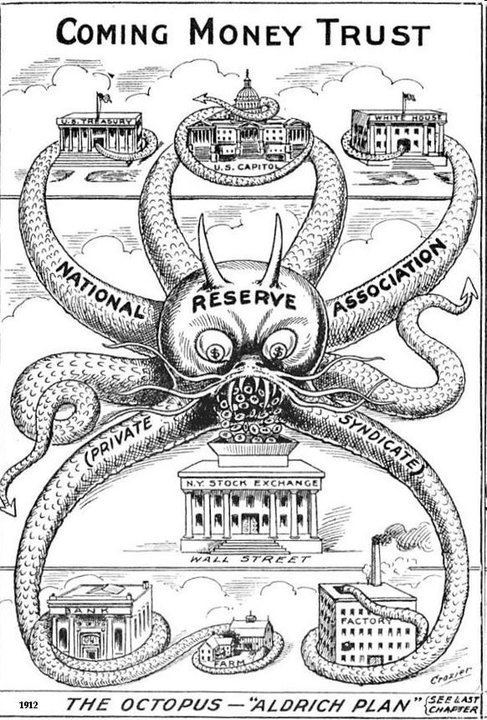

So it should not surprising that Senator Aldrich (R) read that Webster quote at a New York City dinner speech on October 15, 1913 on the eve of the passage of the Federal Reserve Act. He was NOT advocating AGAINST a Fractional Reserve Currency but rather FOR IT! — SEE: aIV Proceedings of the Academy of Political Science #1, at 38 (Columbia University, New York (1914))

For those who might not know the history of Fractional Reserve Banking see: The Magic of Fractional Banking. In essence it is counterfeiting.

https://soundmonetarypolicy.com/wp-content/uploads/2020/03/banksters-11470-20110901-26.jpg

INFLATION or Currency Devaluation:

One of the biggest victories achieved by modern economists and modern central bankers is changing the definition of inflation. Inflation used to mean an increase in the money supply – full stop.

PETER C. SCHMIDT (A very good article)

https://soundmonetarypolicy.com/wp-content/uploads/2020/03/032310Whiskey.jpg

A few more definitions:

Money is metal coins, currency (Bank IOUs) and credit (fairy dust created out of thin air) or even beads and obsidian arrowheads. Money needs to be durable, accepted and dividable which is why precious metals were often the choice.

Money is a generally accepted, recognized, and centralized medium of exchange in an economy that is used to facilitate transactional trade for goods and services.

Investopedia Definition of Money

Wealth is LAND, RESOURCES and the labor that fashions usable and saleable goods.

Wealth is an accumulation of valuable economic resources that can be measured in terms of either real goods or money value.

Investopedia definition of Wealth

Capitalism is a private individual’s wealth, labor and resources reinvested to produce more wealth.

Capitalism is an economic system in which capital goods are owned by private individuals or businesses. The production of goods and services is based on supply and demand in the general market.

@page { size: 8.5in 11in; margin: 0.79in } h2 { margin-top: 0.14in; margin-bottom: 0.08in; background: transparent; page-break-after: avoid } h2.western { font-family: “Liberation Serif”, serif; font-size: 18pt; font-weight: bold } h2.cjk { font-family: “Noto Serif CJK SC”; font-size: 18pt; font-weight: bold } h2.ctl { font-family: “Lohit Devanagari”; font-size: 18pt; font-weight: bold } p { margin-bottom: 0.1in; line-height: 115%; background: transparent } a:link { color: #000080; so-language: zxx; text-decoration: underline }

Investopedia definition of Capitalism

E.M. Smith aka Chiefio, who trained as an economist, gets into the definition of capitalism and other definitions surrounding capitalism: Monopoly, Monopsony, Oligopoly, Collusion And Economics 1 “Evil Socialism” vs “Evil Capitalism” is a short comment by EM describing the continuum between straight capitalism and Communism.

One of the best explanations of the Federal Reserve is by G Edward Griffin. A Talk by G. Edward Griffin-The Creature from Jekyll Island. Unfortunately Griffin is a member of the John Birch Society and is therefore attacked on that basis by the defenders of the Fed. So I am presenting more rigorous sources.

Money Is Created by Banks – Evidence Given by Graham Towers, Governor of the Central Bank of Canada

Some of the most frank evidence on banking practices was given by Graham F. Towers, Governor of the Central Bank of Canada (from 1934 to 1955), before the Canadian Government’s Committee on Banking and Commerce, in 1939… Most of the evidence quoted was the result of interrogation by Mr. “Gerry” McGeer, K.C., a former mayor of Vancouver, who clearly understood the essentials of central banking. Here are a few excerpts:

Q. But there is no question about it that banks create the medium of exchange?

Mr. Towers: That is right. That is what they are for… That is the Banking business, just in the same way that a steel plant makes steel. (p. 287)

The manufacturing process consists of making a pen-and-ink or typewriter entry on a card in a book. That is all. (pp. 76 and 238)

Each and every time a bank makes a loan (or purchases securities), new bank credit is created — new deposits — brand new money. (pp. 113 and 238)

Broadly speaking, all new money comes out of a Bank in the form of loans.

As loans are debts, then under the present system all money is debt. (p. 459)

Q. When $1,000,000 worth of bonds is presented (by the government) to the bank, a million dollars of new money or the equivalent is created?

Mr. Towers: Yes.

Q. Is it a fact that a million dollars of new money is created?

Mr. Towers: That is right.

Q. Now, the same thing holds true when the municipality or the province goes to the bank?

Mr. Towers: Or an individual borrower.

Q. Or when a private person goes to a bank?

Mr. Towers: Yes.

Q. When I borrow $100 from the bank as a private citizen, the bank makes a bookkeeping entry, and there is a $100 increase in the deposits of that bank, in the total deposits of that bank?

Mr. Towers: Yes. (p. 238)

Q. Mr. Towers, when you allow the merchant banking system to issue bank deposits which, with the practice of using the cheques as we have it in vogue today, constitutes the medium of exchange upon which I think 95 per cent of our public and private business is transacted, you virtually allow the banks to issue an effective substitute for money, do you not?

Mr. Towers: The bank deposits are actual money in that sense, yes.

Q. In that sense they are actual money, but, as a matter of fact, they are not actual money but credit, bookkeeping accounts, which are used as a substitute for money?

Mr. Towers: Yes.

Q. Then we authorize the banks to issue a substitute for money?

Mr. Towers: Yes, I think that is a very fair statement of banking. (p. 285)

US banks operate without Reserve

“Banks typically have 3% of their assets in cash in order to meet customer needs. Since 1960, banks have been allowed to use this “vault cash” to satisfy their reserve requirements. Today, bank reserve requirements have fallen to the point where they are now exceeded by vault cash, which means lowering reserve requirements to zero would have virtually no impact on the banking system. US banks are already operating free of any reserve constraints. The graph below shows reserve requirements falling to zero over the last fifty years….”

Eric deCarbonnel

E.M. Smith and other economists, such as Steve Bannon and those he has on the War Room as well as other financial experts are trained (and believe in) Keynesian Economics (IMF.) I prefer Mises and have had arguments with E.M to that effect. (He has started to come around a bit.) It should be noted that Communist spy Harry Dexter White of the US Treasury and Fabian Socialist John Maynard Keyne are the two who saddled the world with the IMF and World Bank via the 1944 Bretton Woods system. I mentioned recently Structural Adjustment Policies, the noose the IMF & World Bank Banksters put around the neck of countries that go bankrupt. There is another Economic Philosophy not connected to the Communists and Fabian Socialists. It was developed by Mises.

Mises on Money by Gary North

This is very long so I want to highlight a few critical points.

#1. Because money is not capital, he [Mises] concluded that an increase of the money supply confers no identifiable social value. If you fail to understand this point, you will not be able to understand the rest of Mises’s theory of money. On this assessment of the value of money, his whole theory of money hinges.

An increase in the quantity of money can no more increase the welfare of the members of a community, than a diminution of it can decrease their welfare. Regarded from this point of view, those goods that are employed as money are indeed what Adam Smith called them, “dead stock, which . . . produces nothing”

#2. New money does not appear magically in equal percentages in all people’s bank accounts or under their mattresses. [New] Money spreads unevenly, and this process has varying effects on individuals, depending on whether they receive early or late access to the new money.

It is these losses of the groups that are the last to be reached by the variation in the value of money which ultimately constitute the source of the profits made by the mine owners and the groups most closely connected with them

[This is a critical point and the reason Bankers can steal our wealth]

This indicates a fundamental aspect of Mises’s monetary theory that is rarely mentioned: the expansion or contraction of money is a zero-sum game. Mises did not use this terminology, but he used the zero-sum concept. Because the free market always maximizes the utility of the existing money supply, changes in the money supply inescapably have the characteristic features of a zero-sum game. Some individuals are made better off by an increase in the money supply; others are made worse off. The existing money is an example of a “fixed pie of social value.” Adding to the money supply does not add to its value.

MISES ON GOLD

…the attempt by modern governments to regulate in any way an international gold standard is always a political ruse to undermine its anti-inflationary bias. “The international gold standard works without any action on the part of governments. It is effective real cooperation of all members of the world-embracing market community. . . . What governments call international monetary cooperation is concerted action for the sake of credit expansion”

“Now, the gold standard is not a game, but a social institution. Its working does not depend on the preparedness of any people to observe arbitrary rules. It is controlled by the operation of inexorable economic law” (p. 462)…..

. . . The role played by ingots in the gold reserves of the banks is a proof that the monetary standard consists in the precious metal, and not in the proclamation of the authorities (p. 67).

In order to effect the acceptance of fiat money or credit money, the State adopts a policy of the abolition of its previous contractual obligations. What was previously a legal right of full convertability into either gold or silver coins is abolished by a new law. The State removes the individual’s legal right to exchange the State’s paper notes for gold or silver coins. It then declares that the new, inconvertible fiat paper money or bank credit money is equal in value to the older redeemable notes, meaning equal to the value of the actual coins previously obtainable through redemption. But the free market determines otherwise. The two forms of money are not equal in value in the judgment of the market’s individual participants. Gresham’s law is still obeyed….

Gresham’s law

The State can set legal prices, meaning exchange ratios, between the various kinds of money. The effects of such fixed exchange rates are identical to the effects of any other kind of price control: gluts and shortages. The artificially overvalued money (glut) replaces the artificially undervalued money (shortage). This cause-and-effect relationship is called Gresham’s law.

MONEY:

Mises therefore defined money as the most marketable commodity. “It is the most marketable good which people accept because they want to offer it in later acts of impersonal exchange” (Human Action, p. 401.).

Money serves as a transmitter of value through time because certain goods serve as media of exchange.

Money transmits value, Mises taught, but money does not measure value. This distinction is fundamental in Mises’s theory of money.

Mises was adamant: there is no measure of economic value.

….Mises concluded that money is neither a consumption good nor a capital good. He argued that production and consumption are possible without money (p. 82). Money facilitates both production and consumption, but it is neither a production good nor a consumption good. Money is therefore a separate analytical category.

“It is illegitimate to compare the part played by money in production with that played by ships and railways. Money is obviously not a ‘commercial tool’ in the same sense as account books, exchange lists, the Stock Exchange, or the credit system”

Because money is not capital, he concluded that an increase of the money supply confers no identifiable social value. If you fail to understand this point, you will not be able to understand the rest of Mises’s theory of money. On this assessment of the value of money, his whole theory of money hinges….

This theory regarding the impact that changes in the money supply have on social value is the basis of everything that follows. Mises offered here a unique assessment of the demand for money. He implied here that an individual’s demand for production goods or consumption goods, when met by increased production, confers an increase in social value or social welfare.

If a producer benefits society by increasing the production of a non-monetary good, later finding a buyer, then society is benefitted because there are at least two winners and no losers.

Therefore, if a producer of gold and a buyer of gold both benefit from an exchange – which they do, or else they would not trade – yet society receives no social benefit, then the analyst has to conclude that some other members of society have been made, or will be made, worse off by the increase in the money supply. This analysis would also apply to decreases in the money supply.

There are two conceptually related issues here: (1) money as a separate analytical category, neither a consumption good nor a production good; (2) changes in the money supply as conveying neither an increase nor decrease in social value.

With that as a background in economics, we look at the Federal Reserve Bank through the eyes of Congressman Wright Patman (D) in 1964 before President Nixon had to close the gold window.

Excerpts from:

A PRIMER ON MONEY

COMMITTEE ON BANKING AND CURRENCY

HOUSE OF REPRESENTATIVES

WRIGHT PATMAN Chairman 1964

Again this is very long, which is why I have posted excerpts. However if you want to understand our Central Banking System this is a very good document to read.

President Lincoln said :

“Money is the creature of law, and the creation of the original issue of money should be maintained as an exclusive monopoly of the National Government. The privilege of creating and issuing money is not only the supreme prerogative of the Government, it is the Government’s greatest opportunity.” [pg 16]

This is very important. Although US citizens can not exchange Federal Reserve notes for treasury gold, official and semi official foreign banks can.

Behind the Federal Reserve notes is the credit of the U.S. Government. If you happen to have a $5, $10, or $20 Federal Reserve note, you will notice across the top of the bill a printed statement of the fact that the US government promises to pay not the Federal Reserve promises to pay. Nevertheless most Americans to do not understand what the US Government promises to pay: American citizens holding these notes cannot demand anything for them except (a) they can be exchanged for other Federal Reserve notes or (b) that they be accepted in payment of taxes and all debts public and private. Certain official or semiofficial foreign banks may exchange any “dollar credits” they may hold-that is, deposits with the commercial banks-for an equal amount of the Treasury’s gold. Americans themselves may not exchange them for gold . [pg 19]

Of the 19 Federal Reserve officials 12 are elected by bankers so HOW the money supply is increase and WHO gets the interest on the US treasury bonds can get very interesting.

The Federal Reserve officials can always decide to create a large portion of any increase in the money supply themselves, though, of course, a larger portion of the supply will always be provided by the private banks under present law. Still the larger portion of Reserve-created money, the more the U.S. Treasury benefits-because all income of the Federal Reserve after expenses reverts to the Treasury. Thus the Treasury receives a good share of the income earned from the Government securities purchased in Reserve money-creating operations.

On the other hand, if the Federal Reserve officials decide that the increase in the money supply they want is all, or substantially all, to be made by the private banks, the private banks acquire and hold more Government securities than in the first case, and the interest payments on these securities go into bank profits. So, whether the Federal Reserve officials decide to favor the U.S. Treasury or the private banks does make a difference-millions of dollars of difference-in the amount of taxes you, I, and all other taxpayers must pay. After all, one of the biggest items of expense of the Federal Government is the interest it must pay on its debt. [pg 36]

[JUMPING FORWARD IN TIME]

“…Although the money in the Federal Reserve is not in anyway “owned” by private banks they get paid interest on it….

In its latest power play, on October 3, 2008, the Fed acquired the ability to pay interest to its member banks on the reserves the banks maintain at the Fed. Reuters reported on October 3:”

“The U.S. Federal Reserve gained a key tactical tool from the $700 billion financial rescue package signed into law on Friday that will help it channel funds into parched credit markets. Tucked into the 451-page bill is a provision that lets the Fed pay interest on the reserves banks are required to hold at the central bank.”

Global Research

[BACK TO WRIGHT PATMAN]

[An incorrect but ] typical explanation runs this way: John Jones deposits $100 in cash with his bank. The bank is required to keep, say, 20 percent of its deposits in reserves, so the bank must deposit $20 of this $100 as reserves, with a Federal Reserve bank. The bank is free to use the other $80, however, to make loans to customers or invest in securities. The expansion of money thus begins. This kind of explanation not only leads to misunderstanding, it also leads to misguided Government policies and rather constant agitation on the part of bankers for other such policies. Many of the smaller bankers who are, on the whole, not as well versed with the mechanics of the money system as they might be, actually believe that they have deposited a portion of their money, or their depositors’ money, with the Federal Reserve. Thus they feel they are being denied the opportunity to make profitable use of this money. Accordingly, there is always agitation to have the Federal Reserve pay the banks interest on this money which they think they have “deposited” with the Federal Reserve.

Furthermore, they are quite certain that the Federal Reserve System has “used” their money to acquire the Government securities which the Federal Reserve may buy in the process of reserve creation. Believing this, the bankers naturally feel that they are entitled to some share of the tremendous profits which the System receives from interest payments on its Government securities. Many bankers know better. The leaders of the bankers’ associations certainly do. But some of these leaders have not hesitated to play on general ignorance and misunderstanding to mobilize the whole banking community behind drives that are nothing but attempts to raid the Public Treasury.

The truth is, however, that the Private banks, collectively, have deposited not a penny of their own funds, or their depositors funds, with the Federal Reserve banks. The impression that they do so arises from the fact that reserves, once created, can be, and are, transferred back and forth from one bank to another, as one bank gains deposits and another loses deposits. [pg 37]Under Secretary of the Treasury Robert V. Roosa, formerly a Vice President of the Federal Reserve Bank of New York, while testifying before the House Committee on Banking and Currency in 1960, described the misconception as follows:

“There is another misconception which occurs much more frequently-that is, the banks think that they give us the reserves on which we operate and that, too, is a misconception. We encounter that frequently, and, as you know, we create those reserves under the authority that has been described here.”The writer [Wright Patman] has had a couple of personal experiences which ‘have provided some amusing confirmation of the fact that the source of bank reserves is not deposits of cash by the member banks with the Federal Reserve banks. having seen reports that the Federal Reserve System had, on a given date, Government securities amounting to a proximately $28 billion, I went on one occasion to the Federal Reserve Bank of New York where these securities are supposed to be housed, and asked if I might be allowed to see them. The officials of this bank said, yes, they would be glad to show them to me; whereupon they opened the vaults and let me look at, and even hold in my hand, the large mound of Government securities which they claimed to have and which, in fact, they did have.

Since I had also seen reports that the member banks of the Federal Reserve System had a certain number of millions of dollars in “cash reserves” on deposit with the Federal Reserve bank, I then asked if I might be allowed to see these cash reserves. This time my question was met with some looks of surprise; the bank officials then patiently explained to me that there were no cash reserves. The cash, in truth, does not exist and never has existed. [pg 38]When the Federal Reserve purchases a $1 million Government bond and gives some bank credit for $1 million in its reserve account, that bank also credits the bond dealer’s checking account with $1 million. I n other words, to acquire $1 million of reserves, the bank also assumes a liability to pay its customers $1 million. If the transactions stopped here, the bank would, of course, come out even, neither gaining anything nor losing anything. But the fact that there is now $1.million more of bank reserves than existed before means that the private banks as a group can create $6 million more money than existed before. In other words, by acquiring this $1 million more in bank reserves, the private banks have the privilege of creating another $6 million of bank deposits, in the process of which they acquire $6 million in interest-bearing securities or loan paper, less an allowance for leakage into the cash (currency) balances of the public. [pg 43]

What amount of Government securities have the private banks acquired with bank-created money?

On January 31, 1964, all commercial banks in this country owned $62.7 billion in U.S. Government securities. The banks have acquired these securities with bank-created money. In other words, the (banks have used the Federal Government’s power to create money without charge to lend $62.7 billion to the Government at interest.

On January 29, 1964, commercial banks had total assets amounting to $304.7 billion, and all of these had been paid for with bank-created money, except $25.4 billion which had been paid for with their stockholders’ capital. In other words, less than 10 percent of the banks’ assets have been acquired with money invested by stockholders in the banks. [pg 46]The make-up of the Federal Reserve Directors changed in favor of the bankers

The Federal Open Market Committee.

There are 19 participants in this powerful body, 7 appointed by the President of the United States and confirmed by the Senate of the United States. Once appointed, however, a man serves for a period of 14 years, and cannot be removed by the President or by any other official body, except for cause. The other 12 men in this select group are elected to their places through the votes of private commercial bankers. there are 12 voting members of the Federal Open Market Committee. The voting members consist of 7 members of the Board of Governors of the Federal Reserve System, plus some 5 of the 12 Federal Reserve bank residents. [pg 65]Because of this, the balance of power over the money supply lay securely, it was thought, with the public side of the System through authority of the Board of Governors. But when the move toward the alternative open-market technique of control was given legislative blessing by Congress in 1933 and 1935 and a full-fledged central bank thereby created the balance shifted radically toward the private, commercial banking side of the System. [pg 72]

.

.

“ownership” of the fed reserve: Confusion due to stock and elected board members:

The position of the Federal Reserve officials thus seems to be clear :

The Federa1 Reserve banks are not owned by the commercial banks. The viewpoint of the individuals quoted above has also been borne out by the presidents of the Federal Reserve banks in hearings before the House Banking and Currency Committee. However, officials of the Federal Reserve banks are sometimes inclined to take the opposite position. [pg 78]

Do bankers believe that they own the Federal Reserve banks.

Yes. [100% of the “stock” is owned by the private banks. Also after instigating “the Accord” It was later revealed by testimony of some of the Federal Reserve officials to committees of Congress that the Open Market Committee had held a meeting on August 18 and decided not only to raise the discount rate, but to “go their own way” on the Government longer term bond rate as well, despite what the President, the Secretary of the Treasury, and the head of the Office of Defense Mobilization might do”….Therefore the Federal Reserve is not answerable to the President or Congress or the electorate, nor even to a government audit or even Congressional funding!]

The original act required that the banks invest 6 percent of their capital stock in the Federal Reserve banks.

Why was the Federal Reserve Act written to require member banks to invest in the so-called stock of the Federal Reserve banks?The framers of the Federal Reserve Act gave many reasons, but the main, reason was this: it was expected that the Federal Reserve would issue money, not mainly against Government securities as is now the practice, but against commercial and industrial loan paper-“eligible paper” as the reader knows.

It was in view of these considerations that Congress, in framing the Federal Reserve Act in 1913, required member banks of the Federal Reserve System to put a certain percentage of their capital into the .’stock” of the Federal Reserve banks; this “stock” was a safeguard against a misuse of the Government’s credit which was being delegated to these banks. The 1013 act placed on the member banks, furthermore, a “double liability” for their “stock” in the Federal Reserve banks. In other words, if a Federal Reserve bank failed, the member banks would lose not only their invested capital, but an equal amount of capital which they would also forfeit. [pg 79]

The 1933 act also prohibited commercial banks from making stock market loans, and investment banks from accepting public deposits. This was an effort to prevent a wave of stock market speculation like that of the twenties by keeping commercial banking and investment banking separate and distinct. [pg 84] [Clinton got rid of that and other limits on the banks.]

What changes were made the Banking Act of 1935?

The Federal Deposit Insurance Corporation was made permanent, and the Board of Governors was given power to change reserve requirements. The act of 1935 had other important revisions :

(1) The Board of Governors of the Federal Reserve System was changed. Membership no longer included the Secretary of the Treasury and the Comptroller of the Currency, and the number of members was cut from nine to seven. The name, the Federal Reserve Board, was changed to the Board of Governors of the Federal Reserve System. The reorganized Board, with its increased powers really gave us a central bank for the first time, in place of a system of individual Federal Reserve banks which were largely on their own.

(2) Also of primary importance in creating a true central bank was the establishment of the Federal Open Market Committee to determine purchases and sales of Government securities for the entire System.

(3) Another change made by the 1935 act related to loans of the Federal Reserve banks. This act allowed the Federal Reserve banks to extend reserve bank credit on any type of credit which the commercial bank possessed.

4 ) The 1935 act also contained provisions concerning regulation of bank holding companies. [Pg 84]Private banks enjoy a very special relationship with the Federal Government. After all, most business firms employ private capital or privately owned resources to produce a product or provide a service which can be profitably sold in the marketplace. Most business firms pay for the raw materials and services they receive, and, furthermore, in the case of most kinds of business firms, the business itself is a risk-taking venture. The firm succeeds or fails in competition with other business firms.

But the conditions under which private banks operate are very different. In the first place, one of the major functions of the private commercial banks is to create money. A large portion of bank profits come from the fact that the banks do create money. And, as we have pointed out, banks create money without cost to themselves, in the process of lending or investing in securities such a Government bonds. Bank profits come from interest on the money lent and invested, while the cost of creating money is negligible. (Banks do incur costs, of course, from bookkeeping to loan officers’ salaries.) The power to create money has been delegated, or loaned, by Congress to the private banks for their free use. There is no charge.

On the contrary, this is but one of the many ways the Government subsidizes the private banking system and protects it from competition. The Government, through the Federal Reserve System, provides a huge subsidy through the free services the System provides for member banks. “Check clearing” is one of the services; i.e., the collection and payment of funds due one bank from another because of depositors’ use of their checkbook money. The costs of this service alone runs into scores of millions of dollars.

The gross expenses of the combined Federal Reserve banks totaled $207 million in 1963, most of which was incurred as a cost of providing free services to the private banks. Other Federal agencies also receive services from the Federal Reserve. But these are not free. The System received about $20 million for “fiscal agency and other expenses” in 1963.In addition, the Federal Government provides private banks with a large measure of protection from competition, and the hazards of failure. … This means, in brief, that nobody can enter the banking business by opening a national bank, unless the proposed bank is to be located where it will not cause an inconvenient amount of competition to other banks already in business. [pg 89]

In mid-August of 1950, however, the Federal Reserve raised the discount rate and short-term Treasury bills jumped toward 11/2 percent, although there were requests from the Secretary of the Treasury and the President for the System to continue a low-rate policy. It was later revealed by testimony of some of the Federal Reserve officials to committees of Congress that the Open Market Committee had held a meeting on August 18 and decided not only t o raise the discount rate, but to “go their own way” on the Government longer term bond rate as well, despite what the President, the Secretary of the Treasury, and the head of the Office of Defense Mobilization might do….

Since the signing of the so-called accord, in March of 1951, this event has been widely interpreted as an understanding, reached between the Treasury and the Federal Reserve, that the Federal Reserve would henceforth be “independent.” It would no longer ” peg Government bond prices. It would raise or lower interest rates as it might see fit, as a means of trying to prevent inflation or deflation.These are understandings which have been grafted onto the accord over the years. Certainly, no such understandings were universal at the time the accord was signed. ….

At the end of 1951, then, the Federal Reserve had both self-proclaimed independence, as a result of the accord, and an operational policy which aimed at maximum credit effects through minimum changes in interest rates….. the Federal Reserve people were quite sure that they could do a better job of running the country than the President, and with only slight increases in interest rates. …

It then added another string to its bow- the “bills only” policy. … Henceforth when the Treasury issued bonds or medium-term securities, it was to dump these issues on the market and watch the natural consequences-first a drop in bond prices, then a gradual recovery as the market absorbed the bonds. Any private rigging or manipulations of the market were to go without interference from the Federal Reserve, as were any speculative booms or panics short of a “disorderly” market. The “bil1s-only” policy had only one reservation: The Federal Reserve would buy long-term bonds in the event that the Open Market Committee made a findings that the market was disorderly. [ full details starting on pg 103]

The [Eisenhower ] administration announced at the outset that it would re1y on monetary policy exclusive1y for its economic regulation and would respect the complete independence of the Federal Reserve to carry out these policies as it saw fit …..

Thirteen years have now passed since the accord and the liberation of the Federal Reserve. What have been the results? The major result is shockingly obvious. Interest rates have climbed steadily, with slight interruptions, during the entire post accord period. (See table 3.) The period has been marked, then, by a continual shift of income to the banks, other major financial institutions, and individuals with significant interest income. The rest of the country provided this income. …

Another result of post accord monetary policy is that the U.S. economy has unwittingly become a low investment economy… The Federal Reserve has chosen the high interest, slower growth option for this country.

In fiscal year 1963, the U S Government paid out approximately $10 billion as interest on the national debt. The budget deficit for the same year was $8.8 billion. Much political hay was made with the deficit. It was potential inflationary dynamite, ran the ”no deficit” claim. And these same people strongly supported tighter money and higher interest rates to prevent the otherwise inevitable inflationary explosion. Yet if these people were really worried about the deficit they should have been rabid partisans of a low-interest policy. For it can be shown that last year’s deficit would have been $5 billion less if the Government had not been forced by Federal Reserve policy to pay increasingly more on its outstanding debt. I n fact, the total national debt would now be $40 billion less if the interest rates of the early 1940’s had prevailed in the postwar period.

Moreover, the system eludes even the audit control exercised by the General Accounting Office, whose function it is to make sure that other Federal agencies not only handle their financial affairs properly but also pursue policies and practices that are in accord with the law. The system provides for its own auditing; clutching its mantle of independence, it has stoutly resisted repeated congressional suggestions that the General Accounting Office perform an annual audit.[ pg 121]

Congress has never given authority for determining monetary policy to the Federal Reserve System-and certainly not to a committee within the System containing members who owe their selection to private bank interests. This basic authorization has not been changed by any amendments to the Federal Reserve Act made to date. Yet two evolutions have taken place within the Federal Reserve System, in one instance, without authorization, and, in the other, directly contrary to the expressed intent of the Federal Reserve Act. In brief, the Federal Reserve’s “monetary policies,” as they are practiced today, were never authorized by law…There is little doubt in the author’s mind that if any legal challenge were ever raised to the Federal Reserve’s monetary policies, the courts could hold them unconstitutional.

The First Annual Report of the Board of Governors after passage of the 1935 act opened with a statement that the act “places responsibility for national monetary and credit on the Board of Governors and the Federal Open Market Committee”-although the act contained no reference whatever to monetary policy nor any provision which indicated a change in the convertibility concept on which the 1913 act was drawn. In brief, the Federal Reserve’s “monetary policies,” as they are practiced today, were never authorized by law.

The monetary powers, as has frequently been pointed out, are reserved to the Congress by the constitution. There is no doubt that it is within the prerogative of the Congress to delegate these powers either to the executive branch of the Government or to an independent agency. But it is not within Congress’s constitutional means to delegate these powers without prescribing policy objectives and clear guidelines detailing how the powers may be used. Inevitably, the Supreme Court has held unconstitutional those grants of powers made without any spelling out of the specific objectives and limitations placed on their use [pg 128]

This second change, whatever else it accomplished, did open the door to private banker influence in the formation of monetary policy. T h e regional bank presidents have become policymakers. At the very least, the type of man chosen to become the president of a regional bank affects the bent of Open Market Committee thinking. Now the private bankers have the dominant voice in choosing the regional bank presidents. They are hardly likely to choose and retain man as presidents whose approach to monetary matters does not in general conform to their taste.

I hope you take the time to read these excerpts and do not blow your blood pressure too high.

“Capitalists with government help are the worst of all economic phenomena.” — A. Rand

Rand was wrong, the absolute worst economic phenomenon is “Capitalists with government help ALL paid for by counterfeit money printed by the Robber Baron Bankers”

The book “Bank Control of Large Corporations in the United States” By David M. Kotz, explains how banks use pension funds to buy controlling interest in large corporations among other strategies.